New York Life – Chicago is proud to be one of the only New York Life Insurance Company General Offices certified to offer the Macro Asset Perspective® planning process. Through this unique educational approach, we can help you better plan for retirement. Whatever stage of life you are in, whether you are working to grow your assets or your assets are working to provide your retirement income, you are likely to glean value from the principles, processes and strategies found in the Macro Asset Perspective®.

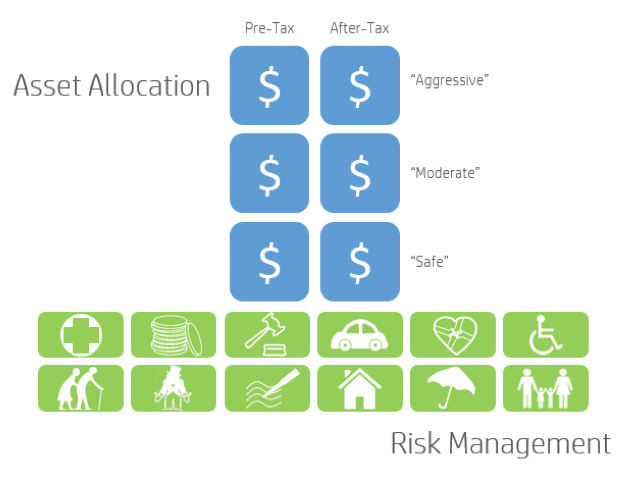

The Macro Asset Perspective® helps you implement a balanced approach to your personal accumulation and income combining time-tested principles of risk management with sensible strategies for long-term tax-reduction giving you the potential to increase your net spendable income in retirement.

While this process was originally developed for a physician's network on the west coast and high-tech engineers in the Silicon Valley, it has been successfully adopted by people of all walks of life and taught at workshops for employees at a number of Fortune 500 companies.